Cash Flow Management Landscape

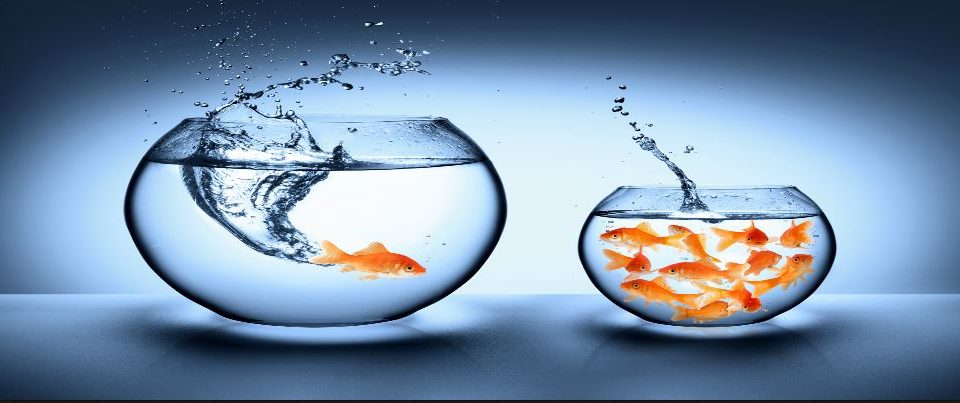

For CFOs, managing liquidity can often feel like a tightrope act: Having little cash on hand might cost you an opportunity. But having too much can rob you of higher yields from long-term investments. In the wake of new regulations, finance leaders are staring down a radically different cash management landscape. Elsewhere, the IRS is making nice with small businesses that had their assets seized on slim suspicions. And IT spending will inch up just 2% this year, which means CFOs overseeing those budgets will have to flex some creativity to meet expanding needs.

4 headlines you-need-to know

1. Corporate treasurers brace for new era in cash management

How your company handles its cash might be dramatically different by the end of the year. Thanks to a spate of reforms intended to strengthen banks’ liquidity, deposits are getting more expensive, and SEC-mandated changes have reduced the potential yield and liquidity of those deposits. That means corporate treasury officials are looking at an entirely new cash management landscape. The Association for Financial Professionals estimates $615 billion in corporate cash might move into low-yield government funds and the like. And a new liquidity survey shows 16% of treasurers plan to add separately managed accounts in response to the SEC’s money fund reforms. (via Association for Financial Professionals)

2. IRS halts small-biz asset seizures

The IRS agreed back in 2014 to stop seizing small business assets when the only suspected illegal activity was improper structuring to avoid reporting bank deposits over $10,000. But the agency hadn’t actually halted those seizures—and hadn’t returned seized funds. That should change, thanks to a congressional hearing that turned up the pressure. Following the hearing, the IRS announced that the agency plans to mail out letters to business with seized assets to initiate a special procedure where they can request return of their property. And moving forward, IRS agents must include evidence of illegal sourcing in affidavits prior to seizing money. (via Accounting Today [log-in required])

3. FASB issues accounting standards update

If you offer a retirement plan, take note: On Thursday, the Financial Accounting Standards Board finally issued its long anticipated accounting standards updates that would require U.S. banks to report loan losses much faster. That could mean lower profits for banks, as they would be forced to set more money aside in reserves. According to the new rule, banks must, at the time the loan is made, record all losses they anticipate over the lifetime of the loan. Current accounting rules delay recognition of loan losses until it is probable the losses have occurred. Banks and public companies that report to the SEC will need to comply with the new standard by late 2019. (via Bloomberg and WSJ.com (log-in required))

4. Federal pension insurer approaching insolvency

The Pension Benefit Guaranty Corporation, the federal pension insurer, stated on Friday that it will face a deficit of $53.4 billion by 2025. That’s big news for companies that offer pensions but should also turn heads in human resources departments across the country. In a report to Congress, PBGC explained that it projects a 50% chance of insolvency by 2025 and a 90% chance by 2028. In order to avoid this almost-certain insolvency, PBGC would need to increase insurance premiums by at least 360%, generating $15 billion in the next decade. PBGC’s reports come after the Treasury Department last month rejected the Central States Pension Fund’s proposal to avoid insolvency by reducing retirement benefits by 23%. (via Washington Post and WSJ.com (log-in required))

The stat: 2%

That’s the estimated amount IT operational spending will increase this year, the lowest since the beginning of the recovery in 2012, according to Computer Economics. The annual study found that smaller organizations are only planning on an average increase of 1.7%, while midsize and larger companies will hit 2.7% and 2.9%, respectively. “We’re hoping that small organizations are not the canary in the coal mine,” Computer Economics’ president Frank Scavo said. Cloud technology and IT security topped the list for planned expenditures. (via CFO.com)