Potential Shakeout for Aircraft Leasing, Adaptive Insights Recognised as Software Leader

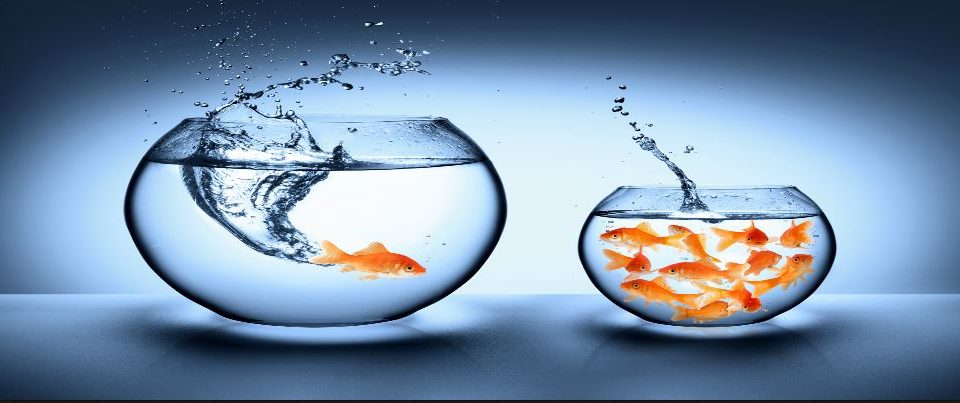

In a recent interview, AerCap CEO Aengus Kelly has revealed his thoughts on a potential shakeout for the aircraft leasing industry, due to the aftershock of years of rapid growth.

A flood of low-cost Chinese funding has shaken up the global leasing market, with Chinese capital now accounting for 28 percent of the $261 billion deployed by leasing firms worldwide, up from 5 percent nine years ago, according to Flightglobal Ascend.

“Issues arise and are much more difficult when the airplane has to be remarketed and that’s when the real challenge comes in,” Kelly told Reuters in an interview on the sidelines of the Singapore Airshow. “We are seeing some of the entrants that came in a few years ago starting to struggle with some of the challenges.”

Kelly said he expected pressure on the newer lessors as interest rates begin to creep up.

At the annual aircraft industry’s gathering in Dublin last month, global air finance titans pondered whether the boom will ever end.

For the full article, click here.

Abu Dhabi Global Market (ADGM), Abu Dhabi’s financial free zone, is in the process of licensing three aircraft leasing companies, it said on Tuesday, as the UAE expands its aviation and aerospace industries.

The three leasing companies are Irish aviation services firms Airborne Capital Limited and Stellwagen Group, and UAE-based aircraft lessor International Airfinance Corporation (IAFC), which manages the US$5 billion Aircraft Leasing Islamic Fund (ALIF) in the Middle East.

“The addition of these prominent companies to ADGM’s aviation finance and leasing sector is another milestone in Abu Dhabi’s progress to becoming a world class, dynamic aviation hub,” ADGM said in a release to media.

The UAE is working to expand its aviation sector beyond the airline industry, investing in becoming a hub for the aviation and aerospace manufacturing and support services industries.

Aircraft leasing is one plank of this strategy. Last August, the Dubai government-backed Dubai Aerospace Enterprise (DAE) acquired Dublin-based lessor Awas, in a deal that tripled the previous number of aircraft on its books and brought its estimated fleet value to over $14bn.

Last week, DAE’s leasing arm DAE Capital set up a dedicated asset management unit, DAE Aircraft Investor Services (DAE-AIS), with the intention of growing its services to clients.

“We are pleased to welcome Airborne Capital, Stellwagen and IAFC to ADGM’s growing family,” Dhaher Al Mheiri, chief executive of the ADGM Registration Authority, said of the forthcoming registrations at ADGM.

“The aviation ecosystem established by ADGM allows companies to integrate existing operational businesses such as lessors, banks, and law firms, with extensive legal structures available tailored to aviation financing and underpinned by English Common law.”

Click here for the full article.

Adaptive Insights has been identified as one of the best software and services companies in Silicon Valley, based on product satisfaction scores from customers and likeliness to recommend ratings from G2 Crowd users. Joining Silicon Valley companies such as Google, Intuit, Survey Monkey, and VMware, Adaptive Insights is one of 25 companies named to this prestigious G2 Crowd list.

“Our customers’ satisfaction is our best measure of success,” said Fred Gewant, chief revenue officer, Adaptive Insights. “We are proud to be recognized as a leader in the Silicon Valley tech scene and join other innovative SaaS and software leaders whose customers are also passionate about their products and solutions. Today’s recognition reinforces the impact we have on our customers’ approach to business planning and showcases the importance of delivering a best-in-class experience.”

Click here for the full article.