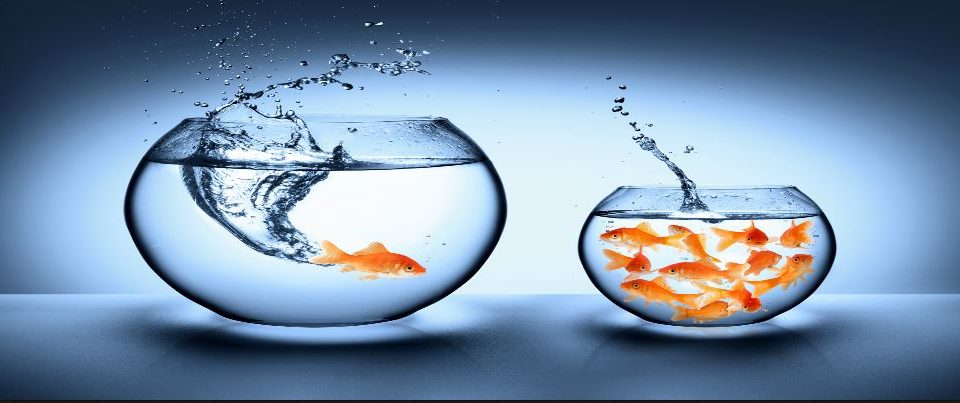

CFO as a change agent

The CFO as a change agent? Just a few short years ago, that idea would have been a real stretch.

However, the digital transformation of companies has become a key driver in turning CFOs into change agents around the globe.

In recent studies by Deloitte, we identified three major technology trends that are transforming finance department operations today: the cloud, robotic process automation, and analytics. Additionally, we identified four trends that will have a transformative impact: advanced analytics, cognitive technologies, in-memory computing, and blockchain.

The CFO as an early adopter

When digging into the key findings of the Deloitte studies, it makes sense to ask: Is the CFO an early adopter of this transformation?

The short answer? Yes. Regardless of common perception, the CFO is, in fact, a driver of digital transformation of finance specifically, and of the entire company in general.

Here’s what’s at the root of this phenomenon:

- The economic advantages that the new technologies offer and the fact that the CFO understands them

- The advantages regarding the speed and the certainty of the information that the CFO needs

- The CFO’s natural tendency to question current or past paradigms, particularly technological ones, which leads him or her to drive changes

- The role of strategy driver when challenging the current organizational thought

The combination of these factors allows the CFO—often perceived as conservative—to quickly adopt new technologies. Other areas of the business, surprisingly enough, often resist incorporating these technologies.

Let’s explore one of the main trends: the growing use of the cloud in finance by CFOs.

Approximately four years ago at Deloitte, we began implementing Adaptive Insights for planning, budgeting, and forecasting in the South and Central America regions. At the time, the subject of the cloud was rife with uncertainties, especially regarding data, performance, security, and corporate and legal rules.

Today, those doubts have almost disappeared, and the consensus is that the cloud is here to stay. The question is when and where each company is going to adopt it.

Based on our experience, the three main drivers of change are:

1. Exponential growth in capability and use of resources

Today, the need to buy an additional server is no longer a strategic concern for the company. The cloud is all-around more efficient than traditional infrastructure and applications.

2. Ease of implementation

Solutions that are designed specifically for the cloud, known as native cloud solutions, are especially easy to use. Many software companies were smart enough to stop fighting spreadsheets and instead just borrow the useful aspects of them.

3. Incremental focus

An incremental focus allows for the possibility of testing with one feature (or with one small group of users), learning from that test, and then progressively expanding its use, looking for tested improvements.

These drivers result in finance departments being enthusiastic adopters of applications in the cloud. We see this in quickly advancing cloud solution installations for managing budgets, consolidation, planning, and reconciliations. It’s interesting to see, even in this category, that the well-respected Gartner Magic Quadrant no longer assesses solutions that do not have the cloud application.

So how can you or your CFO become a change agent? I recommend keeping an open mind, assessing the risks and advantages, and, most of all, testing the concept. There is no going back on using the cloud—it is a matter of the speed with which you want your company to move ahead.