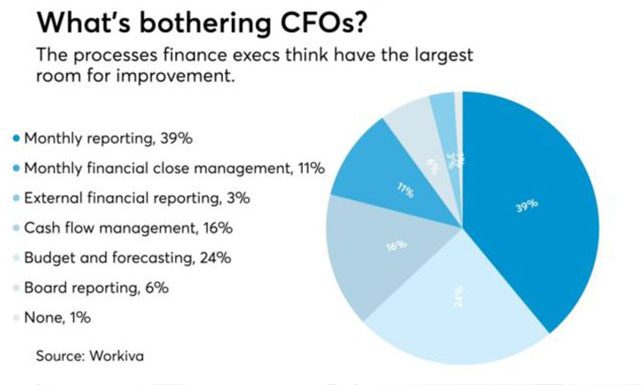

5 Annual FP&A Practices to Ditch in 2018

The typical annual FP&A process is time consuming, error-prone, and too static to handle today’s business challenges, and negotiating for an entire year’s worth of resources and quotas can create tensions amongst competing department managers.

AccountancyAge have published an article on the 5 FP&A practices that can obstruct growth for a future-ready CFO. Those unproductive practices that progressive finance teams must transform or eliminate entirely include:

- Only setting annual targets

Targets are ultimately based on assumptions. They have margins of error, sometimes large ones, and it’s almost impossible to make correct assumptions for an entire year. Shifting focus to quarterly, or even monthly targets, will allow for more flexibility, and prevent departments getting bogged down by missed targets based on flawed information.

- Linking bonuses to budget achievements

This traditional practice sets up a conflict of interest that forces executives to negotiate the lowest possible targets for their team. Rather than making positive contributions to growth, budgeting and planning becomes a race to the bottom.

- Only allocating resources annually

Businesses often continue to pump precious resources into projects that showed clear signs of failing early in the year, simply because there is no requirement to do mid-course corrections. Instead, review results on an ongoing basis and make the relevant changes to drive strategic growth.

- Comparing actuals to last year’s targets

As noted in step 1, annual assumptions are often inaccurate, and it’s a waste of time to reconcile the past and present. Look forward, not backward.

- Only creating an annual budget

This is perhaps the most difficult practice to eliminate, as the annual budget is the lodestone of CFOs and every LoB manager. Annual budgets are hugely time-consuming to create, waste productivity, and cause resources to be misspent on failing projects. They also stifle innovative thinking and big ideas because they are delayed until the next annual budget cycle. Instead, budgeting should be part of a year-round process of analysis and planning, with a rolling 12-month forecast and dynamic resource allocation.

Additionally, finance teams are urged to stop using spreadsheets for anything more than personal calculations.

“Excel is a great tool for one person. But two people are exceeding its capacity”

Instead, finance must embrace new, integrated technologies that can support dynamic, rolling forecasts and budgets.

For the original article, click here.