Improve your reporting process (Without More Caffeine)

Late nights. Working over the weekend. Learning the names of every barista within a quarter-mile radius of the office. If you’re in charge of creating financial reports, you don’t need me to tell you how much work it takes to keep information updated and accurate.

That’s because you’re likely logging into multiple systems to pull information while working with incredibly large amounts of data. The more systems and data, the more effort it takes to model and analyze for presentation.

At the same time, all this data is more valuable than ever. When done well, financial reports can provide insights into the past, present, and future, helping the entire company manage volatility, navigate organizational complexity, meet compliance requirements, and drive the direction of operations. As a result, financial reports have never been more necessary to run the company or more in demand by your boss.

So how can you make reporting more efficient, more effective, and less reliant on espresso? Here are four things you can do to improve your process.

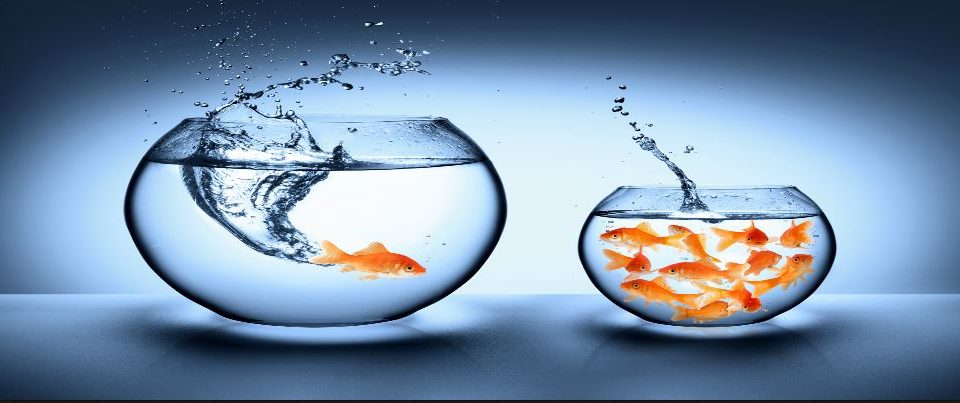

Centralize your data

It might sound scary, but without a central data system you’ll waste countless hours dealing with multiple source systems to pull information. And it’s only going to get worse. Industry experts predict that the digital universe is going to double in size every two years, growing from 4.4 trillion gigabytes in 2013 to 44 trillion gigabytes by 2020. As businesses introduce more and more systems to track every last bit of data, you’re going to simply run out of time if you keep trying to pull all that information separately and manually.

Tailor your message

Not everyone speaks accountant. Your reports aren’t always going to be read by finance professionals. You need to understand the needs of your audience and create reports appropriately. That way, the reporting process becomes a strategic conversation instead of just a wall of numbers. For example, operational leaders might want detailed metrics on their unit, while executives may require a higher-level summary of the entire business. The more you can provide relevant information, the more value your reports will provide.

Get visual

Ask any toddler at bedtime: Stories are always better with pictures. It’s no different in reporting. Data visualization, like charts and graphs, is crucial to good analysis. When you visualize your raw numbers, your audience can see the story the numbers are telling while easily spotting potential problems or outliers. Not only is a picture worth a thousand words, but it can help you understand the worth of a thousand numbers.

Enable self-service reporting

If you had a nickel for every time you had to pull a report for another department, finance would be the most well-funded department in the company. According to the IMA, more than 90% of controllers provide operational data while more than 80% are being used to source business performance and customer data. Sure, you’re happy to help, but pulling reports for everyone else means less time to work on your own valuable strategic activities. By enabling self-service reporting and dashboards, the finance department can take its time back while empowering other departments to get the data they need in seconds instead of waiting for weeks.