Microsoft Excel – How dangerous is it for your business?

Did you know that Microsoft’s Excel is the most dangerous software on the planet? Yes, more dangerous than rogue code & Stuxnet that was deliberately sent off to sabotage Iran’s nuclear program. Yes, the problem using excel for your business is that serious.

Don’t take my word for it, there are some very influential people, regulatory bodies and business talking about the excel issue:

Both the Switzerland-based Basel Committee on Banking Supervision1 (BCBS) and the Financial Services Authority2 (FSA) in the UK have recently made it clear that when relying on manual processes, desktop applications or key internal data flow systems such as spreadsheets, banks and insurers should have effective controls in place that are consistently applied to manage risks around incorrect, false or even fraudulent data. The citation by the BCBS is the first time that spreadsheet management has ever been specifically referenced at such a high level, a watermark in the approach to spreadsheet risk.

To give you and idea of how important this is here’s a great tale from James Kwak:

The issue is described in the appendix to JPMorgan’s internal investigative task force’s report. To summarize: JPMorgan’s Chief Investment Office needed a new value-at-risk (VaR) model for the synthetic credit portfolio (the one that blew up) and assigned a quantitative whiz (“a London-based quantitative expert, mathematician and model developer” who previously worked at a company that built analytical models) to create it. The new model “operated through a series of Excel spreadsheets, which had to be completed manually, by a process of copying and pasting data from one spreadsheet to another.” The internal Model Review Group identified this problem as well as a few others, but approved the model, while saying that it should be automated and another significant flaw should be fixed.** After the London Whale trade blew up, the Model Review Group discovered that the model had not been automated and found several other errors. Most spectacularly,

“After subtracting the old rate from the new rate, the spreadsheet divided by their sum instead of their average, as the modeler had intended. This error likely had the effect of muting volatility by a factor of two and of lowering the VaR . . .”

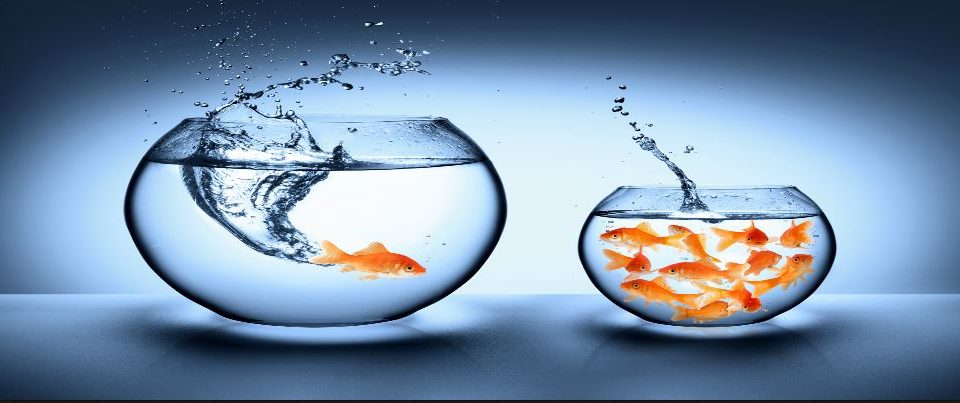

As suggested above, this is the reason why, business want tools which are robust, connected, not complex and easily manageable. Acquiring such tools is a little price to pay, rather than going through the painful audit that excel can lure you into.

Quite simply, without Excel we’d not have had the incredible financialisation of the economy over the past 30 odd years. And if we hadn’t had that then we also wouldn’t have had the financial crash of 2007. So there’s a dangerous piece of software for you.

It’s possible to take this too far of course: but it is still true that without spreadsheets then the financial markets just would not look as they do and much of the history of the past 30 years would be rather different. The interesting argument is whether it would all look better without all that finance: I tend to think not but you’re entirely free to disagree with me.

If you want to read further, the article appeared on Forbes, click here.