Scenario planning that works for you

Safe, Assured Loan Scenario Planning that Works As Fast As You

Intense competition, pressure on margins, increased government regulation, corporate oversight, changing consumer sentiment, global instability – these are some of the many variables to be considered in the increasingly demanding banking business world.

Scenario planning is an essential part of loan portfolio management.

- Can you stress test your mortgage portfolio in real time instead of in days or weeks?

- Can you run real time scenarios for the full range of risk factors and outcomes or any combination of these?

- Can you fully segment your portfolio profitability?

- Can you get immediate insight into complex cash flow forecasting and funding scenarios?

- Have you transitioned from risky spreadsheets to enterprise standard tools?

If you answered NO to any of the above read on.

Spreadsheets Are Holding Your Business Back

Give your business the assurance and commercial edge it needs

Model Risk

Banks’ increasing dependence on business modelling means that banks have to manage model risk better. The consequences of model failure can be extreme. Spreadsheets are simply unsuitable for bank modelling and it is indefensible for a bank to carry out complex modelling using unsuitable tools.

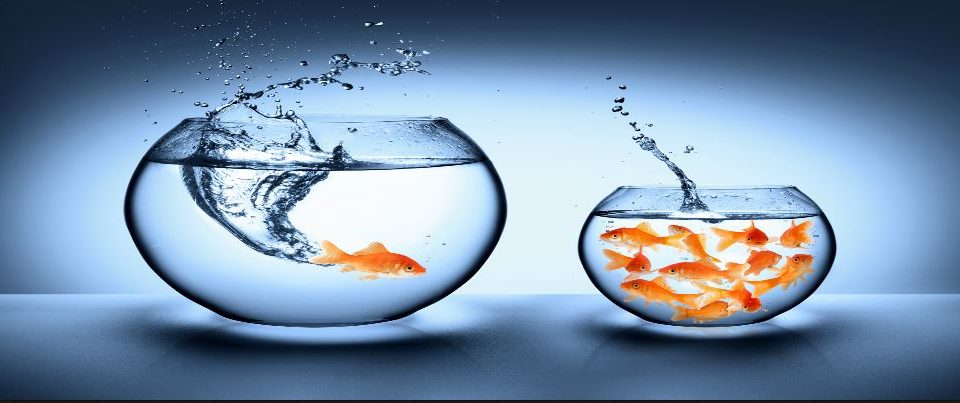

Commercial Edge

Having high-quality information at your disposal makes all the difference. Quickly see the potential margins and impact, so you can plan for multiple scenarios to guide you in making better commercial decisions. Miagen Solutions give your business speed, flexibility and agility to deliver real competitive advantage.

Miagen solutions

Miagen provide complete forecasting solutions giving you so much more than spreadsheets: scenarios in minutes, all information about portfolio income and expenses, assets and liabilities and segmented profitability. Most importantly, all Miagen solutions are robust, enterprise standard.

Model risk

Manage model risk with Miagen solutions, built on the Adaptive Insight CPM platform. At the heart of the platform is an in-memory planning and analysis engine that enables instantaneous calculations. Workflow and business process tracking allows teams to collaborate in real time. Based on cloud standards, the Adaptive relational database store ensures the utmost data integrity as well as a level of reliability that proprietary data stores simply can’t deliver. With Adaptive Insights, you can easily manage what users can see or change, whether that’s dashboards, reports, sheets, calculations, or individual cells. Create once, and our security model does the rest. Standards-based single sign-on makes secure access to Adaptive Insights easy, while SSAE 16, EU-US Safe Harbor, and TRUSTe compliance ensures your peace of mind.

The difference is speed

Drive commercial decisions faster. Unlike spreadsheets that were never designed to handle masses of complex data, Miagen solutions performance never wavers. Designed and built to be a single repository for all of your data, and because it’s in the cloud it’s securely accessible from any location on multiple devices. And because the information and models within the system are fully integrated, you can update it quickly and easily, and see the results in seconds.

Goodbye to spreadsheets

Intuitive and easy to use, with user interfaces that look and act like a spreadsheet, so you don’t lose time on the learning curve. Miagen solutions work the way you do. And because it’s a database under the hood, you benefit from scalability and performance without sacrificing usability.

- Reduce the reporting and forecasting cycle by days or weeks

- Build multiple scenarios quickly and easily

- Free your team to spend more time considering commercial decisions and risk

- Maintain loan portfolio and all information associated with those loans

- Maintain your debt portfolio and any schedules that may apply

- Provide full financial statements

All information in a single source; no segregation across multiple systems.

A business advantage like no other, information at the push of a button.

Miagen solutions gives loan companies strong reporting and forecasting, with features such as:

- Portfolio re-balancing

Let Miagen solutions handle all acquisitions, disposals and securitisation decisions. Assemble a sample portfolio to evaluate your trading options by comparing possible portfolio types in a variety of combinations, for impact on profitability, cashflow and risk.

- Run what-if scenarios

Stress test your portfolio against a range of possible outcomes. Fine-tune your planning by testing scenarios that include all variables such as interest rate rises, and seeing all possible results.

- Link actuals to forecast

Because Miagen solutions hold all actuals at group level, you get more accurate and reliable rolling forecasts instead of needing to source actuals from finance or incomplete data from contract systems.

- Secure and scalable

Miagen solutions are cloud-based, so you don’t need to invest in hardware, or IT support all updates are handled seamlessly and automatically. They scale easily as your business grows, and they are accessible across multiple devices, so you’re never far away from the information you need to make a decision.

Run 12 scenarios within a day; instead of one scenario in weeks.

Transform your FP&A process.

Dynamic dashboards and intelligent reporting

- Easy-to-build customisable dashboards and reports

- Multi-dimensional views and portfolio drill-down available

- See your portfolio by multiple dimensions

- Connect directly to the data, so adjustments and amendments are immediately visible

- Complex calculations delivering key portfolio financial and metrics

- Change parameters easily

- Link to your treasury management system to collate all asset portfolio and debt-related data in a single environment

- Multi dimensional portfolio reporting including on customer, intermediary, asset type down to individual asset for profitability, cashflow, risk profiles etc.

- Carry out complex cash forecasting and scenario planning.