Simplicity the key for the strategic CFO

Finance Transformation? Get the numbers right, and get the right numbers – that was one of the key lessons from the CFO Roundtable group which met in Stockholm earlier this month.

Finance professionals gathered from a cross-section of company sizes, from multibillion organisations to nimble startups, spanning industries from insurance, technology and media to manufacturing, financial services and facilities management.

The group organises discussion and information sharing events where CFOs can share best practice and network with peers in an informal setting. Here were some of the key talking points from the the finance transformation lunch event at the Grand Hotel in Stockholm.

Simplicity

Some of the group spoke about how their business has evolved to spending less time on financial figures. If the numbers are well managed, they look after themselves, leaving the business to spend more time concentrating on operational drivers.

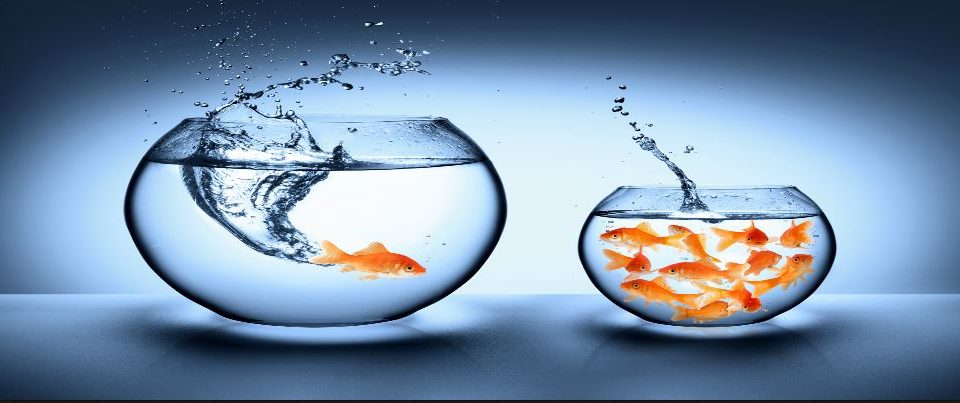

The key to achieving this is having a good structure of reliable information. This means moving away from reams of unnecessary data and simplifying around fewer information points delivered to the right person. It’s more effective to have fewer operational KPIs that are relevant. This also results in greater agility because changing course is easier when fewer elements need to be changed.

Compliance

Many of the group were very vocal about the burden of regulation and legislation that compels them to produce information in many different ways for tax purposes, or if listed on the stock exchange. Some discussed the possibility of using a forum like this group to invite politicians, and give them a better sense of the challenges facing businesses when complying with legislation.

Blank page

Agility also emerged when one of the group, who is CFO at a newly formed technology company, asked a great question: what advice would the others give if she had a blank page to build a finance function. Some CFOs in large established companies with data warehouses could only dream of such a scenario.

Among the advice she was given was to focus on variable costs, and to outsource non-core items. This enables the business to focus on the key skills it needs, so that it’s a lot more agile to change. One speaker from the financial sector said the best approach is to have a good, structured information system.

Risk

Another lively discussion point centred on how CFOs find themselves caught in the conflict between the audit committee, which will naturally advise against risk, and the business, where entrepreneurial leadership leans towards taking risks – albeit qualified ones.

Involvement

One of the attendees explained how some in her finance team don’t monitor specifics, as they believe it’s not part of their role. She argued that these colleagues would benefit from having an idea of the components their company produces and how it assembles products. This way, they would not only be able to spot errors but they would be better able to provide more input to the wider business.

This drove the belief that CFOs have a responsibility to drive change rather than waiting for it, and to push the boundaries of specific, rigid finance roles. There was also discussion about CFOs needing to educate other departments in the organisation.

Disruption

There was consensus among the CFOs that few things are more frustrating than having to produce historical analysis that’s no longer relevant or meaningful to the business, but is expected for traditional reasons such as IPO.

This led to a lively discussion around unnecessary reports, and one of the group suggested it’s time for finance to disrupt the status quo by showing the business the true cost of these reports. If finance were to ‘charge’ for reports, it would quickly identify what information the business finds really relevant.

Some companies can be slow to change, but a provocative idea like that could help strategically focused CFOs to drive a change towards simpler reporting and fewer metrics. We can expect to see plenty more debate about this at future CFO roundtable events.