Scenario Planning for UK oil price hike

A cracked oil pipeline from the North Sea is causing massive shifts in global markets. Brent crude rose to its highest level in over 2 years, as reported by Financial Times- reaching a high point of $65.70 per barrel, up 1.6%- before dropping back to $65.33.

The trading pattern follows news that the North Sea’s main pipeline system, which carries 450,000 barrels a day, was likely to be shut for weeks to repair a leak.

The Forties Pipeline System (FPS) delivers almost 40% of UK North Sea oil and gas production. Its shutdown for several weeks, announced on Monday, will have an immediate knock-on effect on operators in the region that rely on its capacity and have insufficient scenario planning in place. Traders are already scrambling to secure imports.

The shutdown, despite being temporary, will have wide-reaching implications for the UK oil and gas industry,” said Wood Mackenzie analyst Fiona Legate. “Companies with fields utilising the FPS export route will suffer from reduced cash flows during the shutdown period.”

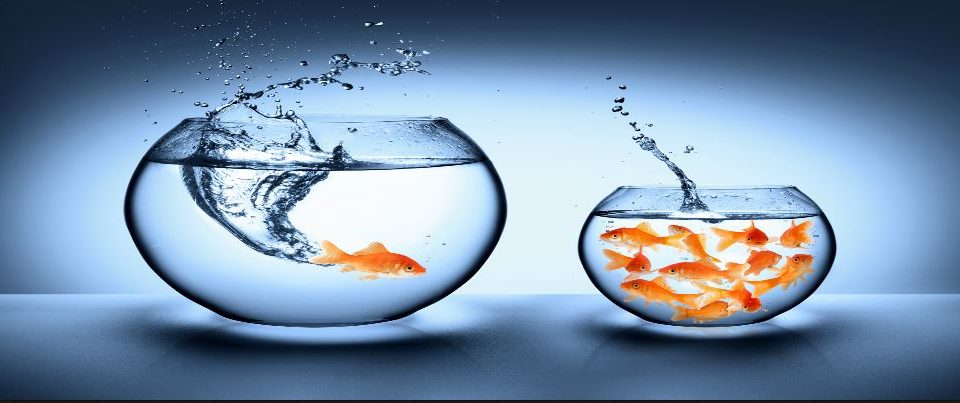

The variable nature of oil availability, along with other resources, can lead to huge modifications in assumptions made by companies, regarding annual revenues and expenses, and cash flow management. Real time scenario planning and stress testing are becoming increasingly essential in planning for a full range of risk factors and outcomes to any combination of these.

Purpose-built planning and forecasting software, such as Adaptive Insights, enables rolling forecasts with integrated driver-based scenarios that can be tuned in real-time. With the latest actuals and assumptions, in addition to responsive calculations and reports– Adaptive allows for course correction when variables go in the wrong direction, as is currently the case for oil importers.

To read the full Financial Times article, click here.